I think that was the point. Trump had a great economy for most of his time in office and ran up the debt anyway. Biden inherited a poor economy (not Trump's fault.. see COVID). That gives you fewer options.You are a total low IQ if you describe Trumps pre covid economic performance anything other than historically exceptional and I am not even joking here. Please come back with realism instead of partial party centric BS.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

National Debt

- Thread starter TigerGrowls

- Start date

The debt running up is something that has occurred under all potus terms since Nixon went off the gold standard I would bet, so Trump cannot be ticked for that. Now it went up exponentially fast in the last year of his term due to the China Virus bio attack on the world. The increase in the national debt is part of that compounding interest going on along with yearly deficits. The tally that China Joe will rack up by the time his term is done will dwarf anything done before and its just going to get worse. 33 trillion debt and rising fast is the biggest threat to the national security of the US imo.I think that was the point. Trump had a great economy for most of his time in office and ran up the debt anyway. Biden inherited a poor economy (not Trump's fault.. see COVID). That gives you fewer options.

I agree with some of this. A caviot here is that the budget was balanced under Bill Clinton... My point here is that all we heard from you was crickets on the debt while Trump was in office. The economy was great as you said yourself. Trump PROMISED to balance the budget while he was President and yet ran up more debt than anyone.The debt running up is something that has occurred under all potus terms since Nixon went off the gold standard I would bet, so Trump cannot be ticked for that. Now it went up exponentially fast in the last year of his term due to the China Virus bio attack on the world. The increase in the national debt is part of that compounding interest going on along with yearly deficits. The tally that China Joe will rack up by the time his term is done will dwarf anything done before and its just going to get worse. 33 trillion debt and rising fast is the biggest threat to the national security of the US imo.

Hey, maybe I'm wrong though... Trump was in office from January of 2017 to January of 2021, show us a post of yours that was complaining about the debt and Trump running it up during those years. Then I'll tip my hat and say I'm sorry. Otherwise, this is just another post by you complaining about anyone and everyone that isn't Trump.

Look at my original post in this thread. It is non partisan. Republicans and democrats are to blame for this current shit show.I agree with some of this. A caviot here is that the budget was balanced under Bill Clinton... My point here is that all we heard from you was crickets on the debt while Trump was in office. The economy was great as you said yourself. Trump PROMISED to balance the budget while he was President and yet ran up more debt than anyone.

Hey, maybe I'm wrong though... Trump was in office from January of 2017 to January of 2021, show us a post of yours that was complaining about the debt and Trump running it up during those years. Then I'll tip my hat and say I'm sorry. Otherwise, this is just another post by you complaining about anyone and everyone that isn't Trump.

Will you ever tell us which grocery store chain you work for? We don’t need to know which one, just the chain.

What happens when we can’t service the debt.

www.wsj.com

www.wsj.com

Opinion | Government Bubble Burst

Treasury bond investors have been taking a historic beating.

The US is literally the swimmer being pulled down by a cinder block with the national debt interest payment. Now more than we spend on military. Something is about to give and its going to be seismic imo.

Hmm. Groceries are still way more expensive. Housing is unaffordable. The rate of growth of inflation may be lower, but the net impact of inflation is still quite present. And the rate hikes used to curb inflation have locked many out of home ownership, depressing available inventory and making payments out of reach.

And what’s up with the S&P dropping 10% in the last 3 months? Combine that with your dollar being worth less, and man, what a hit to retirement savings.

And that's why it's insane - despite all the odds being stacked against it, despite what the Fed is doing to curb spending, the economy just won't slow down. All that hand wringing about a recession looks silly in hindsight.Hmm. Groceries are still way more expensive. Housing is unaffordable. The rate of growth of inflation may be lower, but the net impact of inflation is still quite present. And the rate hikes used to curb inflation have locked many out of home ownership, depressing available inventory and making payments out of reach.

And what’s up with the S&P dropping 10% in the last 3 months? Combine that with your dollar being worth less, and man, what a hit to retirement savings.

My clients in the southern states are having a harder time selling, bc their clientele has been getting an unhealthy dose of right-wing media telling them the country was going to collapse since day 1 of biden's presidency. Much like when obama was president, the streets were on fire until the day trump took office.And that's why it's insane - despite all the odds being stacked against it, despite what the Fed is doing to curb spending, the economy just won't slow down. All that hand wringing about a recession looks silly in hindsight.

My clients in the southern states are having a harder time selling, bc their clientele has been getting an unhealthy dose of right-wing media telling them the country was going to collapse since day 1 of biden's presidency. Much like when obama was president, the streets were on fire until the day trump took office.

Is that it, or is it the 7-8% mortgage rates? If I bought my house today, my mortgage payment would be 4.5X what it currently is (built in 2016).

Is that it, or is it the 7-8% mortgage rates? If I bought my house today, my mortgage payment would be 4.5X what it currently is (built in 2016).

Home ownership is not relevant to what my clients sell.

Home ownership is not relevant to what my clients sell.

Oh I assumed you were talking about selling their homes. What do they sell?

Thank you President Trump for the great tax plans and trade agreements you crafted in your term that is keeping the economy going despite the never before seen ineptitude of the 3rd Obama term.And that's why it's insane - despite all the odds being stacked against it, despite what the Fed is doing to curb spending, the economy just won't slow down. All that hand wringing about a recession looks silly in hindsight.

Worst jobs record in modern history!Thank you President Trump for the great tax plans and trade agreements you crafted in your term that is keeping the economy going despite the never before seen ineptitude of the 3rd Obama term.

Worst jobs record in modern history!

JOBS JOBS JOBS and empty promises.

$8 TRILLION added to the debt. Yah, gimme more of that!JOBS JOBS JOBS and empty promises.

In my opinion, the housing issue is most impacted by the fed actions....obviously...., but supply and demand is part of it. But other categories, i.e. groceries, are being manipulated by corporate maneuvers to push the consumer as far as they can for profits. They want to find the point at reach there will be a market reaction. But just my theory. S&P is also a Wall Street manipulation. Dollar value is no factor. Some industries are better off with it lower and some higher. Usually a wash over all.Hmm. Groceries are still way more expensive. Housing is unaffordable. The rate of growth of inflation may be lower, but the net impact of inflation is still quite present. And the rate hikes used to curb inflation have locked many out of home ownership, depressing available inventory and making payments out of reach.

And what’s up with the S&P dropping 10% in the last 3 months? Combine that with your dollar being worth less, and man, what a hit to retirement savings.

S&P is also a Wall Street manipulation. Dollar value is no factor. Some industries are better off with it lower and some higher. Usually a wash over all.

Doesn’t help my retirement account. Certainly not a wash. Sucks losing a massive amount in 3 months while the economy is supposedly doing well.

Would be seismic. I am not holding my breath for this but there is some smoke with multiple parties mentioning it.

Not sure if this is hocum or not, but posting for posterity as more than a few are posting on X that something big is getting ready to go down on the economy. MSM is not reporting it for sure.

The U.S. Banksters Are ALREADY plugged into the Quantum Financial System (via @Reuters)

Putin signs the currency PEG agreement tomorrow! (Wednesday)

Anytime after the agreement signing,

China is likely to turn up the gold price to $2,200 immediately which goes into the weekend,

Oil price dramatically drops. Remember fiat vs gold price.

Likely on Monday, China raises the gold price to $2,500 and collapses the U.S. fiat dollar oil price to between 40-$50 bbl.

The U.S. Treasury bonds are no longer the “global reserve asset” collateral that trades global oil to value America’s debt.

There’s your U.S. Treasury bond sovereign debt collapse.

By China collapsing the U.S. fiat oil price to 40-$50 bbl.

JPMORGAN Jamie Dimon knows what’s coming next week.

There’s your true reset.

Next weeks FOMC meeting will mean nothing because the U.S. Treasury bond will be no more.

Powell won’t need to worry about rates in a non-existing U.S. Treasury bond(s)

Everything falls down next week!-Cheers everyone

P.S. I called the peg agreement at 2:00AM last night

The U.S. Banksters Are ALREADY plugged into the Quantum Financial System (via @Reuters)

Putin signs the currency PEG agreement tomorrow! (Wednesday)

Anytime after the agreement signing,

China is likely to turn up the gold price to $2,200 immediately which goes into the weekend,

Oil price dramatically drops. Remember fiat vs gold price.

Likely on Monday, China raises the gold price to $2,500 and collapses the U.S. fiat dollar oil price to between 40-$50 bbl.

The U.S. Treasury bonds are no longer the “global reserve asset” collateral that trades global oil to value America’s debt.

There’s your U.S. Treasury bond sovereign debt collapse.

By China collapsing the U.S. fiat oil price to 40-$50 bbl.

JPMORGAN Jamie Dimon knows what’s coming next week.

There’s your true reset.

Next weeks FOMC meeting will mean nothing because the U.S. Treasury bond will be no more.

Powell won’t need to worry about rates in a non-existing U.S. Treasury bond(s)

Everything falls down next week!-Cheers everyone

P.S. I called the peg agreement at 2:00AM last night

Last edited:

Your tax dollars so hard at work......

www.zerohedge.com

www.zerohedge.com

Zero Public EV Chargers Built Since Congress Approved $7.5 Billion To Expand Network | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

🚨🚨ALERT ALERT ALERT 🚨🚨🚨

🚨🚨Bank of Japan has collapsed

🚨🚨Federal Reserve has collapsed

🚨🚨SoftBank has collapsed

The currency PEG’s signed between OPEC (Putin’s visit to Saudi Arabia & UAE on Putin’s visit yesterday) and the Central Bank of Russia’s chief Elvira Nabiullina brought an end to the petrodollar.

🚨🚨The $1.1t of U.S. Treasury bonds held at the Bank of Japan, as the CARRY TRADE UNWINDS,

The Bank of Japan has collapsed

SoftBank collapsed,

The Federal Reserve has now also collapsed,

The signed PEG agreements (between OPEC) ending the petrodollar and ISO 20022 and Basel III have collapsed the $34t U.S. Treasury bonds,

That’s why yields exploded on both the JGB 10yr and US10Y at the same time,

Now expect massive monetary deflation,

It’s over for the U.S. Dollar.

U.S. Treasury bonds are now worthless.

Gold will now move much higher and the oil price in dollar terms will collapse,

This will now ALL unravel in the coming hours, a few days.

-Cheers everyone

P.S. see my 11:42AM tweet from yesterday

Hoping this guy is not right but I could see it being correct.

🚨🚨🚨Why the U.S. Dollar now has no monetary value,

🚨🚨🚨Now that the renminbi is the "global reserve currency" for oil trade because its gold-backed and OPEC has now pegged their currencies to the RMB,

🚨🚨🚨O.K. Now let's go into the foreign exchanges, what countries are acquiring dollars???

No one!

Analogy is like, "what countries are acquiring Indian rupees?"

No one!

When Russia takes Indian rupees when they sell oil to India, what will Russia do with them?

Burn them!

Why?

India, like the United States doesn't produce shit,

So if other countries hold dollars, what would they now do with them!?

Burn them! 🔥

Why would the world ever need to trade their currencies for U.S. Dollars on the FX if it has no monetary backing??

Meaning other countries can now get renminbi currency (in the foreign exchanges) to get OPEC oil.

There’s no need for dollars in the FX, EVER!

From here on out…

Now you're witnessing the global collapse of the fiat dollar as evidenced by the failing bank of Japan, who still holds $1.1t U.S. Treasury bonds,

Where the dollar is no longer to be traded on the FX,

Because I no longer need dollars to get oil.

There's your USD currency collapse.

The U.S. Treasury was able to create $34t in debt that inflated financial assets,

If no one needs dollars on the FX, what happens to U.S. financial asset values? Equity markets?

COLLAPSE

Why do you think by China internationalizing the renminbi, they will be able to help poor countries dig up their gold?

Because gold has real monetary value.

Gold is your monetary anchor.

This is why the bank of Japan has collapsed,

The yen has collapsed

Do you honestly believe the Bank of Japan can sell those worthless U.S. Treasury bonds back to the Federal Reserve?

Why would the Fed want to buy them back from BoJ?

Because the USD has no monetary value in the foreign exchanges.

Because the U.S. Dollar no longer has any monetary anchor to oil.

The Petrodollar died on Tuesday when Putin signed the currency pegs with UAE and Saudi Arabia designating the RMB as the “global monetary asset” currency for oil trade.

The Fed sure as hell ain't going to buy their worthless shit paper back from the BoJ!

And even if the Fed did buy it back,

Who would U.S. Treasury Secretary Janet Yellen re-loan those Dollars out to at 5% interest??

🤣🤣🤣🤣

The Bank of Japan couldn’t even give those dollars away in the FX if it wanted too.

No country wants them nor do they need them.

Treasury bonds yields will collapse

Oil price in dollar terms will collapse

The U.S. Treasury bonds themselves now have no value,

Gold will experience a bull run.

So now, how about that $20 trillion carry trade that will destroy the Bank of Japan and the G7 Central Banks??

Milton Friedman once said, "we're going to let the magic of the marketplace cure everything"

P.S. See my 12:43AM tweet from last night.

🚨🚨🚨Why the U.S. Dollar now has no monetary value,

🚨🚨🚨Now that the renminbi is the "global reserve currency" for oil trade because its gold-backed and OPEC has now pegged their currencies to the RMB,

🚨🚨🚨O.K. Now let's go into the foreign exchanges, what countries are acquiring dollars???

No one!

Analogy is like, "what countries are acquiring Indian rupees?"

No one!

When Russia takes Indian rupees when they sell oil to India, what will Russia do with them?

Burn them!

Why?

India, like the United States doesn't produce shit,

So if other countries hold dollars, what would they now do with them!?

Burn them! 🔥

Why would the world ever need to trade their currencies for U.S. Dollars on the FX if it has no monetary backing??

Meaning other countries can now get renminbi currency (in the foreign exchanges) to get OPEC oil.

There’s no need for dollars in the FX, EVER!

From here on out…

Now you're witnessing the global collapse of the fiat dollar as evidenced by the failing bank of Japan, who still holds $1.1t U.S. Treasury bonds,

Where the dollar is no longer to be traded on the FX,

Because I no longer need dollars to get oil.

There's your USD currency collapse.

The U.S. Treasury was able to create $34t in debt that inflated financial assets,

If no one needs dollars on the FX, what happens to U.S. financial asset values? Equity markets?

COLLAPSE

Why do you think by China internationalizing the renminbi, they will be able to help poor countries dig up their gold?

Because gold has real monetary value.

Gold is your monetary anchor.

This is why the bank of Japan has collapsed,

The yen has collapsed

Do you honestly believe the Bank of Japan can sell those worthless U.S. Treasury bonds back to the Federal Reserve?

Why would the Fed want to buy them back from BoJ?

Because the USD has no monetary value in the foreign exchanges.

Because the U.S. Dollar no longer has any monetary anchor to oil.

The Petrodollar died on Tuesday when Putin signed the currency pegs with UAE and Saudi Arabia designating the RMB as the “global monetary asset” currency for oil trade.

The Fed sure as hell ain't going to buy their worthless shit paper back from the BoJ!

And even if the Fed did buy it back,

Who would U.S. Treasury Secretary Janet Yellen re-loan those Dollars out to at 5% interest??

🤣🤣🤣🤣

The Bank of Japan couldn’t even give those dollars away in the FX if it wanted too.

No country wants them nor do they need them.

Treasury bonds yields will collapse

Oil price in dollar terms will collapse

The U.S. Treasury bonds themselves now have no value,

Gold will experience a bull run.

So now, how about that $20 trillion carry trade that will destroy the Bank of Japan and the G7 Central Banks??

Milton Friedman once said, "we're going to let the magic of the marketplace cure everything"

P.S. See my 12:43AM tweet from last night.

Not good.

ca.finance.yahoo.com

ca.finance.yahoo.com

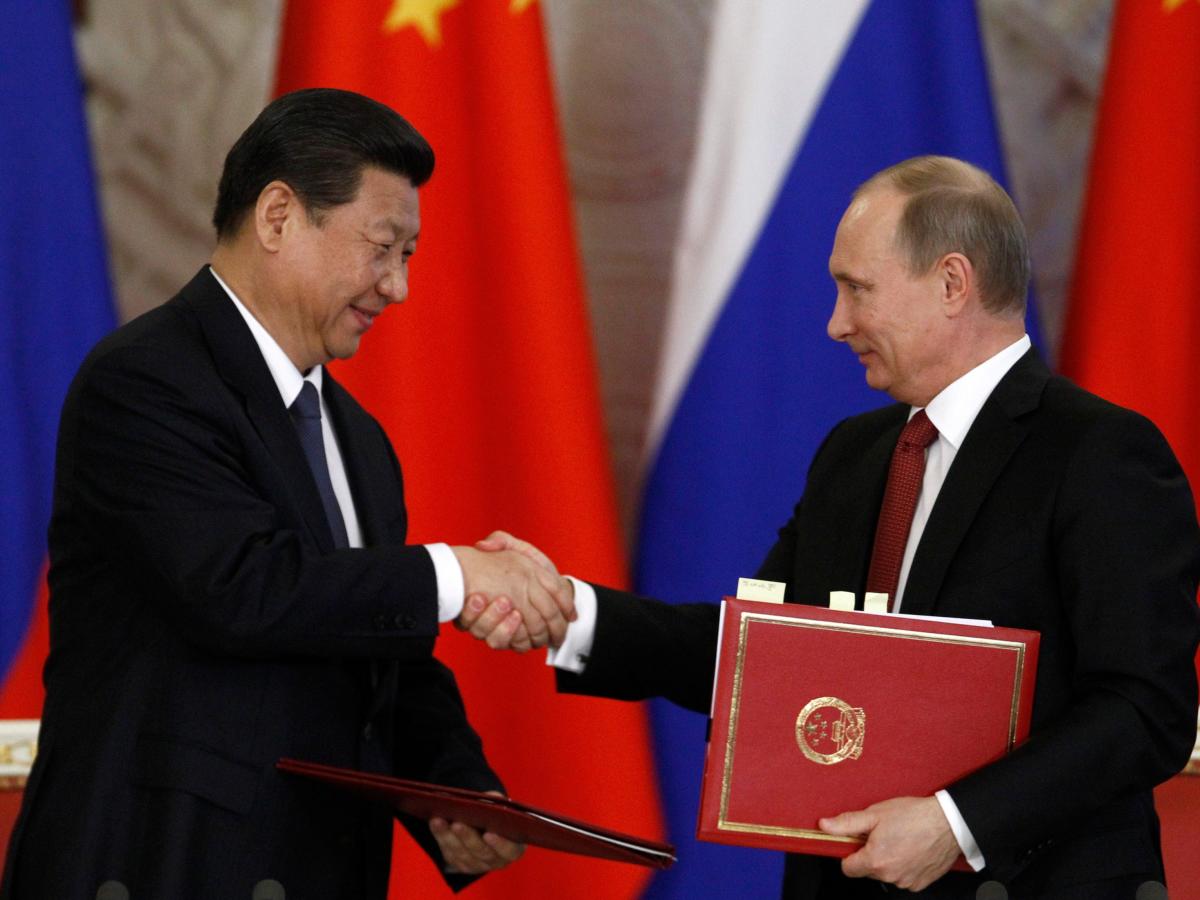

China and Russia have almost completely abandoned the US dollar in bilateral trade as the push to de-dollarize intensifies

China and Russia have almost completely abandoned the US dollar in bilateral trade as the push to de-dollarize intensifies

China and Russia have more than 90% de-dollarized their bilateral trade, Russia's prime minister has said.

Mitch McConnell said we have to pass a budget and spend more money on the military and fund the wars.

Unsustainable.

www.cnbc.com

www.cnbc.com

The U.S. national debt is rising by $1 trillion about every 100 days

The U.S. national debt is rising by $1 trillion about every 100 days

The nation's debt now stands at nearly $34.4 trillion.

A

anon_5e8aassgcbjz1

Guest

How much did the national debt decrease by when Trump was in office?Unsustainable.

The U.S. national debt is rising by $1 trillion about every 100 days

The U.S. national debt is rising by $1 trillion about every 100 days

The nation's debt now stands at nearly $34.4 trillion.www.cnbc.com

Have I tried to pin this just on dems? Nope. This is a deep state establishment problem. Anyone trying to throw shit on Trump for all the money shelled out after the covid shutdown is wrong.How much did the national debt decrease by when Trump was in office?

A

anon_5e8aassgcbjz1

Guest

Sure, let’s do the first 2 years of his presidency then with a Republican controlled Congress. How much did debt decrease by?Have I tried to pin this just on dems? Nope. This is a deep state establishment problem. Anyone trying to throw shit on Trump for all the money shelled out after the covid shutdown is wrong.

Nobody made Donnie sign those budgets. He sure liked those tax cuts.

Dude look at how much the debt has increased exponentially more under each potus. You claim a high iq so I know you are just shit talking. LOL!!Sure, let’s do the first 2 years of his presidency then with a Republican controlled Congress. How much did debt decrease by?

Nobody made Donnie sign those budgets. He sure liked those tax cuts.

Similar threads

- Replies

- 1

- Views

- 149

- Replies

- 0

- Views

- 134

- Replies

- 79

- Views

- 3K

- Replies

- 17

- Views

- 1K

ADVERTISEMENT

ADVERTISEMENT