Nice current summary.

justthenews.com

justthenews.com

"The purposeful exclusion of the 2014 and 2015 years sanitized the most substantive criminal conduct and concealed material facts," Shapley stated.

By Ben Whedon and Nicholas Ballasy

Updated: June 22, 2023 - 7:52pm

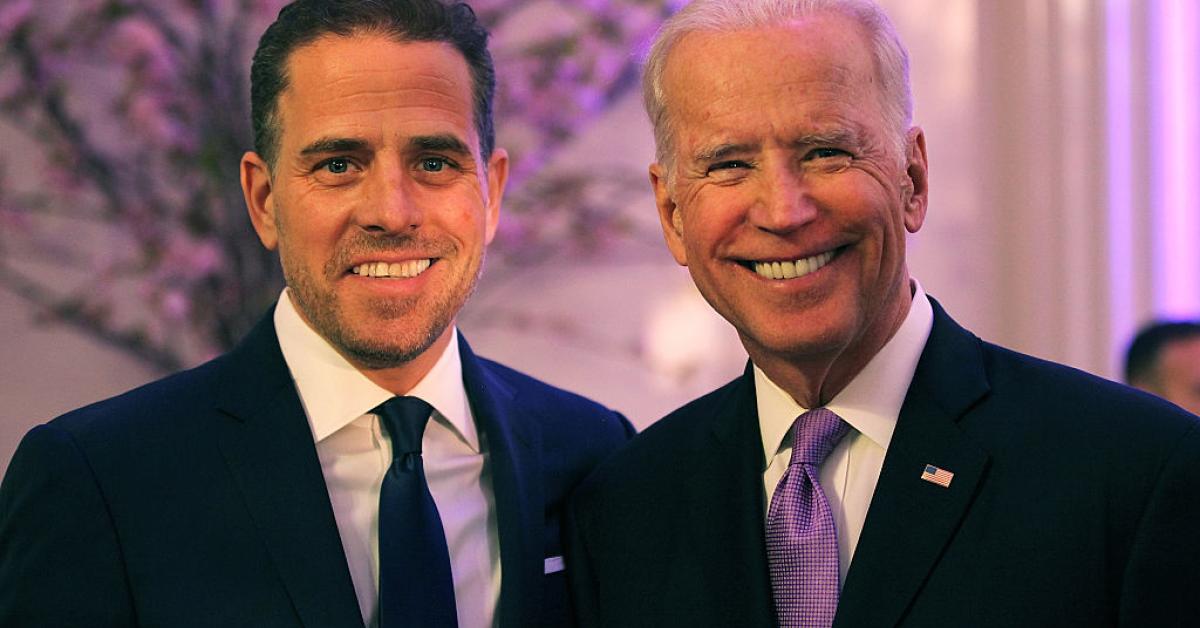

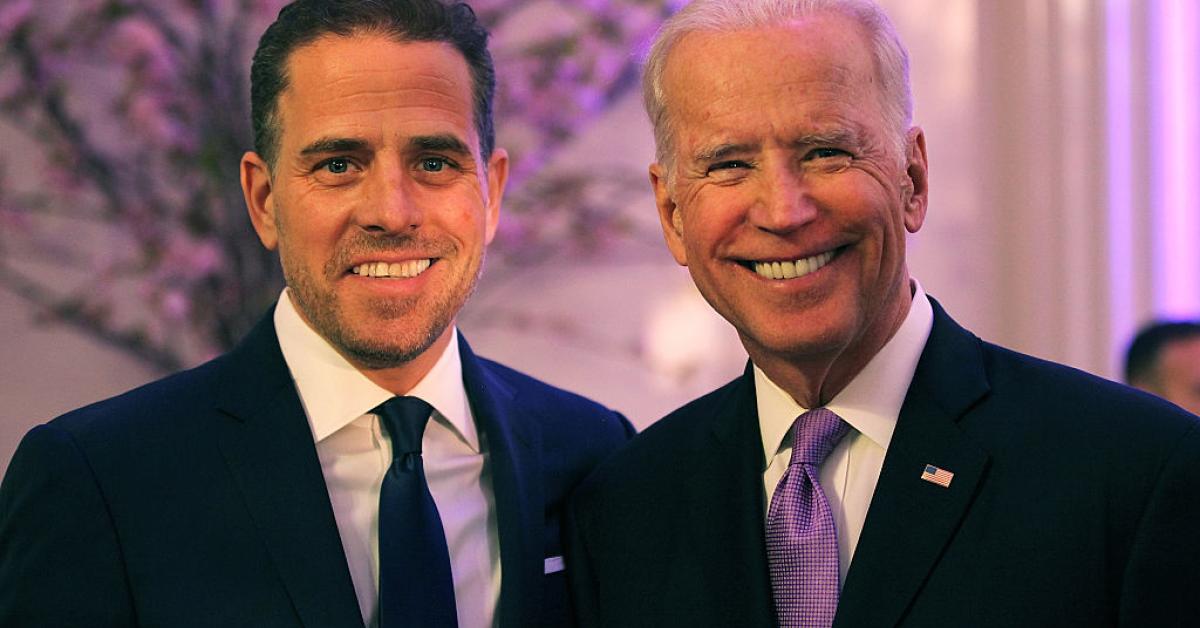

Two IRS whistleblowers who worked on the Hunter Biden tax investigation testified to the House Committee on Ways and Means in recent weeks attesting to the Department of Justice's hamstringing of U.S. Attorney David Weiss and his ability to pursue the case.

Biden reached a deal with the DOJ earlier this week to plead guilty to two tax charges and a gun violation that could potentially be dismissed. The DOJ is recommending he receive no prison time.

Gary Shapley, who led the IRS agents working on the case, initially came forward alleging that political officials had intervened to prevent the bringing of charges against the first son and that Weiss lacked sufficient authority to do so on his own. After Shapley came forward, the DOJ removed his entire team from the case.

One of his subordinate agents, who remains unidentified, has since come forward to corroborate most of Shapley's claims. The pair testified to the committee in separate interviews, revealing the extent to which the DOJ hampered the case.

File

Whistleblower 1 Transcript_Redacted.pdf

File

Whistleblower 2 Transcript_Redacted.pdf

Here are the top 10 takeaways from their testimonies:

Prosecutors resisted IRS efforts to ramp up the investigation before the election

The unnamed whistleblower recounted disagreements between the IRS whistleblowers on the case and the prosecutors about taking aggressive steps to pursue the investigation.

"So one of the first disagreements I recall between the IRS investigators and the prosecutors was the idea of going overt," he said. "When we work criminal tax investigations, there's an IRS policy in place that we need to interview the subject within 30 days of elevating the investigation."

The agent insisted that he lobbied heavily for the case to "go overt" as a means of putting Hunter on notice and to preserve relevant materials, but was overruled, allegedly due to concerns that it would compromise evidence on the FBI side of the case.

"I was overruled during multiple meetings almost to the point that I couldn't bring it up anymore to the attorneys, and they would get visually upset with me. And I was continually being told that we had to stay covert to preserve potential evidence from the FBI side of the investigation," he continued. "So we did not end up going overt and conducting interviews until after the 2020 election on December 8th, 2020, after I continually pushed the issue at various meetings."

Shapley indicated that the team had prepared documentation to support more aggressive investigative efforts in April 2020, including interviews and searches, but that career DOJ officials "dragged their feet" on the IRS pursuing them.

"By June 2020, those same career officials were already delaying overt investigative actions. This was well before the typical 60- to 90-day period when DOJ would historically stand down before an election. It was apparent that DOJ was purposely slow-walking investigative actions in this matter," he said.

DOJ repeatedly squashed search warrants

Shapley's testimony detailed materials suggesting the IRS ought to seek a search warrant for the Biden estate in Delaware and that Assistant United States Attorney Lesley Wolf had agreed there was probable cause. She did however, reportedly agree that much of the needed evidence would be in the Bidens' guest house but that they would never get approval for such a search.

He further contended that the prosecutors wanted to remove Hunter Biden's name from the search warrants and document requests, and that a DOJ tax line attorney had insisted doing so would produce "most" of the relevant data. Shapley expressed incredulity that the DOJ would regard "most" as a sufficient target for an investigative effort.

Wolf, he said, informed him in early September that the DOJ's Office of Enforcement Operations was sitting on a search warrant for "emails for Blue Star Strategies."

Acting Deputy Attorney General Richard Donoghue on September 4th, 2020, ordered that the DOJ cease all overt investigative activities due to the upcoming election. The DOJ typically stands down for 60 to 90 days ahead of the contest. The order further delayed the IRS agents from taking major investigative steps.

Later in the year, on Oct. 22, 2020, Wolf said that Weiss had reviewed the search warrant for Hunter Biden's residence and agreed that it established probable cause. Shapley informed the committee that, despite that conclusion, prosecutors would not authorize a physical search warrant on Hunter Biden.

"Even though the legal requirements were met and the investigative team knew evidence would be in these locations, AUSA Wolf stated that they would not allow a physical search warrant on Hunter Biden," he said.

Shapley and his team never managed to interview Hunter, nor other Bidens

Before directly seeking to interview Hunter, Shapley and his team needed to verify his residence and sought to conduct a "walk-by" to that effect.

"We would go in general clothes, walk by the residence, see what's going on, see if there's Secret Service," the anonymous whistleblower stated, though such an operation was vetoed by the DOJ.

"Tax does not approve. This will be on hold until further notice," read the DOJ email he referenced that shut down the plan.

Ultimately, the walk-by never occurred and Shapley went to interview Hunter at his residence on the December 8th "day of action" but that Hunter declined to be interviewed.

Subsequently, the Department of Justice Tax Division held a taxpayer conference with Biden and his defense counsel. Such a proceeding affords the subject of a case the opportunity to dissuade the DOJ from pursuing charges and to outline their defense.

While the DOJ does not always include the investigators at such meetings, the second whistleblower stated that the IRS team had asked to attend it and the DOJ denied their request.

The day of action was also supposed to include interviews with other individuals, including James and Sara Biden, but they were not allowed to conduct those interviews. He did assert that they managed to serve both with a records request, however.

Prosecutors limited questions about Joe Biden

Shapley recalled that, during a Dec. 3 planning meeting for the day of action, the IRS agents discussed the game plan for pursuing interviews, including Hunter Biden associate Ron Walker.

Shapley indicated that the IRS team wanted to asked about an email reading "Ten held by H for the big guy" and hoped to identify both parties in the statement.

Assistant U.S. Attorney Wolf, however, intervened and insisted they should not ask any questions about "dad," in an apparent reference to Joe Biden. The decision prompted outrage from both the FBI and IRS teams but Wolf stood her ground.

The FBI did manage to interview Walker on the day in question and, Shapley asserted, secured some comment on the letter by not directly asking about it, technically complying with Wolf's decision. Shapley asserted that the line of questioning was "clearly valuable for the investigators to ask about Hunter Biden's dad," noting that Walker subsequently described Joe Biden's interaction with some of Hunter's business associates.

IRS agents couldn't get access to the Hunter Biden laptop

As late as Oct. 22, 2020, the IRS agents had not secured access to the now-notorious and verified personal computer of the target of their investigation.

Shapley described a meeting on that date with the FBI's computer analysis team and said that at that meeting, Wolf stated "prosecutors decided to keep it from the investigators."

"Investigators assigned to this investigation were obstructed from seeing all the available evidence," Shapley stated. "It is unknown if all the evidence in the laptop was reviewed by agents or by prosecutors."

A key Biden appointee blocked the pursuit of some of the most serious charges

In March of 2022, The DOJ Tax Division sent its prosecution memo to the United States Attorney's Office for the District of Columbia, the office that had venue relating to the 2014 and 2015 tax year elements of the case.

Shapley and the FBI case agent had requested to be a part of the presentation, but were denied. Department of Justice Tax Division Mark Daly told the case agent that the First Assistant at the office was optimistic and planned to assign an assistant U.S. Attorney to aid the case.

Within days, the team learned that the Biden-appointed D.C. U.S. Attorney, Matthew Graves, had personally reviewed the case and would not support it, effectively curtailing any and all ability of the team to pursue charges in that venue.

Shapley contended that the team did not realize the development at the time, saying "[w]e knew that President Biden-appointed U.S. Attorney Matthew Graves did not support the investigation, but DOJ and United States Attorney Weiss allowed us to believe that he had some special authority to charge."

He then pointed to testimony from Attorney General Merrick Garland, who stated on April 26th, 2022, that "[t]he Hunter Biden investigation is being run by and supervised by the United States Attorney for the District of Delaware. He is in charge of that investigation. There will not be interference of any political or improper kind."

Shapley took that to mean that "that they were still deciding whether to charge 2014 and 2015 tax violations."

DOJ rejected Weiss's request to be named special counsel

Weiss evidently lacked any unstated authority to pursue D.C. charges. Shapley stated that Graves had refused to let Weiss pursue charges in the district.

"This resulted in United States Attorney Weiss requesting special counsel authority from Main DOJ to charge in the District of Columbia," he continued, adding that Weiss's request was denied.

He went on to note that the decision killed the last chance of pursuing the 2014 and 2015 charges, as the statute of limitations on the alleged crimes would eventually expire.

"The years in question included foreign income from Burisma and a scheme to evade his income taxes through a partnership with a convicted felon. There were also potential FARA issues relating to 2014 and 2015," he went on. "The purposeful exclusion of the 2014 and 2015 years sanitized the most substantive criminal conduct and concealed material facts."

WhatsApp Messages connected Joe Biden to Hunter's business deals

The second unnamed whistleblower said that there were WhatsApp messages found where Hunter mentioned his father, President Joe Biden, in the context of business deals.

"Hunter is saying this in those WhatsApp messages, that: I'm sitting here with my dad ready to make a deal, we're waiting for the phone call," according to the whistleblower's recollection of the messages. "We couldn't believe that we saw that. That was more indication that the dad might have been involved."

Biden met CEFC, Chinese business client of Hunter’s

Shapley recalled Rob Walker, a business associate of Hunter’s, describing a meeting that Joe Biden attended with the Chinese company, CEFC.

“Walker went on to describe an instance in which the former Vice President showed up at a CEFC meeting,” Shapley said.

“Walker said: ‘We were at the Four Seasons and we were having lunch and he stopped in, just said hello to everybody. I don't even think he drank water. I think Hunter Biden said, 'I may be trying to start a company or try to do something with these guys and could you?' And I think he was like, if I'm around and he'd show up,’” he recounted.

Agents never saw the Biden FD-1023 Form

The FBI and IRS agents investigating Biden never received the "Confidential Human Source" information on a form FD-1023, which outlined an alleged bribery deal where a Burisma executive paid $5 million to Hunter and another Biden family member, according whistleblower testimony and documents released by the House Ways and Means Committee.

“In news articles, former AG William Barr is cited in saying that this Form 1023 was reviewed by the Western District of Pennsylvania and was ultimately shared with David Weiss, U.S. Attorney overseeing the subject Investigation,” according to a letter written by the IRS whistleblower’s attorney to the committee’s GOP chair, Jason Smith, and its Democratic ranking member, Richard Neal.

“As Mr. X has testified, he was the IRS-CI Case Agent over the subject investigation at the time – and Mr. X has stated to me that he has never seen this FBI Form 1023 and that he does not recall ever hearing about this information being turned over in any meetings with the prosecution team in Delaware,” the attorney also wrote.

Ben Whedon is an editor and reporter for Just the News. Follow him on Twitter.

Top 10 Hunter Biden bombshells from IRS whistleblower testimonies

"The purposeful exclusion of the 2014 and 2015 years sanitized the most substantive criminal conduct and concealed material facts," Shapley stated.

"The purposeful exclusion of the 2014 and 2015 years sanitized the most substantive criminal conduct and concealed material facts," Shapley stated.

By Ben Whedon and Nicholas Ballasy

Updated: June 22, 2023 - 7:52pm

Two IRS whistleblowers who worked on the Hunter Biden tax investigation testified to the House Committee on Ways and Means in recent weeks attesting to the Department of Justice's hamstringing of U.S. Attorney David Weiss and his ability to pursue the case.

Biden reached a deal with the DOJ earlier this week to plead guilty to two tax charges and a gun violation that could potentially be dismissed. The DOJ is recommending he receive no prison time.

Gary Shapley, who led the IRS agents working on the case, initially came forward alleging that political officials had intervened to prevent the bringing of charges against the first son and that Weiss lacked sufficient authority to do so on his own. After Shapley came forward, the DOJ removed his entire team from the case.

One of his subordinate agents, who remains unidentified, has since come forward to corroborate most of Shapley's claims. The pair testified to the committee in separate interviews, revealing the extent to which the DOJ hampered the case.

File

Whistleblower 1 Transcript_Redacted.pdf

File

Whistleblower 2 Transcript_Redacted.pdf

Here are the top 10 takeaways from their testimonies:

Prosecutors resisted IRS efforts to ramp up the investigation before the election

The unnamed whistleblower recounted disagreements between the IRS whistleblowers on the case and the prosecutors about taking aggressive steps to pursue the investigation.

"So one of the first disagreements I recall between the IRS investigators and the prosecutors was the idea of going overt," he said. "When we work criminal tax investigations, there's an IRS policy in place that we need to interview the subject within 30 days of elevating the investigation."

The agent insisted that he lobbied heavily for the case to "go overt" as a means of putting Hunter on notice and to preserve relevant materials, but was overruled, allegedly due to concerns that it would compromise evidence on the FBI side of the case.

"I was overruled during multiple meetings almost to the point that I couldn't bring it up anymore to the attorneys, and they would get visually upset with me. And I was continually being told that we had to stay covert to preserve potential evidence from the FBI side of the investigation," he continued. "So we did not end up going overt and conducting interviews until after the 2020 election on December 8th, 2020, after I continually pushed the issue at various meetings."

Shapley indicated that the team had prepared documentation to support more aggressive investigative efforts in April 2020, including interviews and searches, but that career DOJ officials "dragged their feet" on the IRS pursuing them.

"By June 2020, those same career officials were already delaying overt investigative actions. This was well before the typical 60- to 90-day period when DOJ would historically stand down before an election. It was apparent that DOJ was purposely slow-walking investigative actions in this matter," he said.

DOJ repeatedly squashed search warrants

Shapley's testimony detailed materials suggesting the IRS ought to seek a search warrant for the Biden estate in Delaware and that Assistant United States Attorney Lesley Wolf had agreed there was probable cause. She did however, reportedly agree that much of the needed evidence would be in the Bidens' guest house but that they would never get approval for such a search.

He further contended that the prosecutors wanted to remove Hunter Biden's name from the search warrants and document requests, and that a DOJ tax line attorney had insisted doing so would produce "most" of the relevant data. Shapley expressed incredulity that the DOJ would regard "most" as a sufficient target for an investigative effort.

Wolf, he said, informed him in early September that the DOJ's Office of Enforcement Operations was sitting on a search warrant for "emails for Blue Star Strategies."

Acting Deputy Attorney General Richard Donoghue on September 4th, 2020, ordered that the DOJ cease all overt investigative activities due to the upcoming election. The DOJ typically stands down for 60 to 90 days ahead of the contest. The order further delayed the IRS agents from taking major investigative steps.

Later in the year, on Oct. 22, 2020, Wolf said that Weiss had reviewed the search warrant for Hunter Biden's residence and agreed that it established probable cause. Shapley informed the committee that, despite that conclusion, prosecutors would not authorize a physical search warrant on Hunter Biden.

"Even though the legal requirements were met and the investigative team knew evidence would be in these locations, AUSA Wolf stated that they would not allow a physical search warrant on Hunter Biden," he said.

Shapley and his team never managed to interview Hunter, nor other Bidens

Before directly seeking to interview Hunter, Shapley and his team needed to verify his residence and sought to conduct a "walk-by" to that effect.

"We would go in general clothes, walk by the residence, see what's going on, see if there's Secret Service," the anonymous whistleblower stated, though such an operation was vetoed by the DOJ.

"Tax does not approve. This will be on hold until further notice," read the DOJ email he referenced that shut down the plan.

Ultimately, the walk-by never occurred and Shapley went to interview Hunter at his residence on the December 8th "day of action" but that Hunter declined to be interviewed.

Subsequently, the Department of Justice Tax Division held a taxpayer conference with Biden and his defense counsel. Such a proceeding affords the subject of a case the opportunity to dissuade the DOJ from pursuing charges and to outline their defense.

While the DOJ does not always include the investigators at such meetings, the second whistleblower stated that the IRS team had asked to attend it and the DOJ denied their request.

The day of action was also supposed to include interviews with other individuals, including James and Sara Biden, but they were not allowed to conduct those interviews. He did assert that they managed to serve both with a records request, however.

Prosecutors limited questions about Joe Biden

Shapley recalled that, during a Dec. 3 planning meeting for the day of action, the IRS agents discussed the game plan for pursuing interviews, including Hunter Biden associate Ron Walker.

Shapley indicated that the IRS team wanted to asked about an email reading "Ten held by H for the big guy" and hoped to identify both parties in the statement.

Assistant U.S. Attorney Wolf, however, intervened and insisted they should not ask any questions about "dad," in an apparent reference to Joe Biden. The decision prompted outrage from both the FBI and IRS teams but Wolf stood her ground.

The FBI did manage to interview Walker on the day in question and, Shapley asserted, secured some comment on the letter by not directly asking about it, technically complying with Wolf's decision. Shapley asserted that the line of questioning was "clearly valuable for the investigators to ask about Hunter Biden's dad," noting that Walker subsequently described Joe Biden's interaction with some of Hunter's business associates.

IRS agents couldn't get access to the Hunter Biden laptop

As late as Oct. 22, 2020, the IRS agents had not secured access to the now-notorious and verified personal computer of the target of their investigation.

Shapley described a meeting on that date with the FBI's computer analysis team and said that at that meeting, Wolf stated "prosecutors decided to keep it from the investigators."

"Investigators assigned to this investigation were obstructed from seeing all the available evidence," Shapley stated. "It is unknown if all the evidence in the laptop was reviewed by agents or by prosecutors."

A key Biden appointee blocked the pursuit of some of the most serious charges

In March of 2022, The DOJ Tax Division sent its prosecution memo to the United States Attorney's Office for the District of Columbia, the office that had venue relating to the 2014 and 2015 tax year elements of the case.

Shapley and the FBI case agent had requested to be a part of the presentation, but were denied. Department of Justice Tax Division Mark Daly told the case agent that the First Assistant at the office was optimistic and planned to assign an assistant U.S. Attorney to aid the case.

Within days, the team learned that the Biden-appointed D.C. U.S. Attorney, Matthew Graves, had personally reviewed the case and would not support it, effectively curtailing any and all ability of the team to pursue charges in that venue.

Shapley contended that the team did not realize the development at the time, saying "[w]e knew that President Biden-appointed U.S. Attorney Matthew Graves did not support the investigation, but DOJ and United States Attorney Weiss allowed us to believe that he had some special authority to charge."

He then pointed to testimony from Attorney General Merrick Garland, who stated on April 26th, 2022, that "[t]he Hunter Biden investigation is being run by and supervised by the United States Attorney for the District of Delaware. He is in charge of that investigation. There will not be interference of any political or improper kind."

Shapley took that to mean that "that they were still deciding whether to charge 2014 and 2015 tax violations."

DOJ rejected Weiss's request to be named special counsel

Weiss evidently lacked any unstated authority to pursue D.C. charges. Shapley stated that Graves had refused to let Weiss pursue charges in the district.

"This resulted in United States Attorney Weiss requesting special counsel authority from Main DOJ to charge in the District of Columbia," he continued, adding that Weiss's request was denied.

He went on to note that the decision killed the last chance of pursuing the 2014 and 2015 charges, as the statute of limitations on the alleged crimes would eventually expire.

"The years in question included foreign income from Burisma and a scheme to evade his income taxes through a partnership with a convicted felon. There were also potential FARA issues relating to 2014 and 2015," he went on. "The purposeful exclusion of the 2014 and 2015 years sanitized the most substantive criminal conduct and concealed material facts."

WhatsApp Messages connected Joe Biden to Hunter's business deals

The second unnamed whistleblower said that there were WhatsApp messages found where Hunter mentioned his father, President Joe Biden, in the context of business deals.

"Hunter is saying this in those WhatsApp messages, that: I'm sitting here with my dad ready to make a deal, we're waiting for the phone call," according to the whistleblower's recollection of the messages. "We couldn't believe that we saw that. That was more indication that the dad might have been involved."

Biden met CEFC, Chinese business client of Hunter’s

Shapley recalled Rob Walker, a business associate of Hunter’s, describing a meeting that Joe Biden attended with the Chinese company, CEFC.

“Walker went on to describe an instance in which the former Vice President showed up at a CEFC meeting,” Shapley said.

“Walker said: ‘We were at the Four Seasons and we were having lunch and he stopped in, just said hello to everybody. I don't even think he drank water. I think Hunter Biden said, 'I may be trying to start a company or try to do something with these guys and could you?' And I think he was like, if I'm around and he'd show up,’” he recounted.

Agents never saw the Biden FD-1023 Form

The FBI and IRS agents investigating Biden never received the "Confidential Human Source" information on a form FD-1023, which outlined an alleged bribery deal where a Burisma executive paid $5 million to Hunter and another Biden family member, according whistleblower testimony and documents released by the House Ways and Means Committee.

“In news articles, former AG William Barr is cited in saying that this Form 1023 was reviewed by the Western District of Pennsylvania and was ultimately shared with David Weiss, U.S. Attorney overseeing the subject Investigation,” according to a letter written by the IRS whistleblower’s attorney to the committee’s GOP chair, Jason Smith, and its Democratic ranking member, Richard Neal.

“As Mr. X has testified, he was the IRS-CI Case Agent over the subject investigation at the time – and Mr. X has stated to me that he has never seen this FBI Form 1023 and that he does not recall ever hearing about this information being turned over in any meetings with the prosecution team in Delaware,” the attorney also wrote.

Ben Whedon is an editor and reporter for Just the News. Follow him on Twitter.